Equity

Vantage Infrastructure’s equity business has been investing in European infrastructure since 2005 and manages US$1.0bn of assets across the Energy, Transportation, Environment and Data sectors

Investment Strategy and Asset Selection

Vantage Infrastructure primarily targets sustainable equity investments in Europe.

Asset Management

We aim to lead and influence business outcomes by controlling risks and enhancing value, in order to maximise returns through active asset management processes and strategies.

These include operational efficiencies, driving growth, mitigating actions for risks identified during due diligence and value-creating exit strategies.

Tailored ESG action plans are formulated for each asset within a consistent and resilient framework, that aims to reduce the portfolio’s overall sensitivity to macroeconomic risks and shock events and capture value opportunities from sustainability and energy transition.

Portfolio

Current

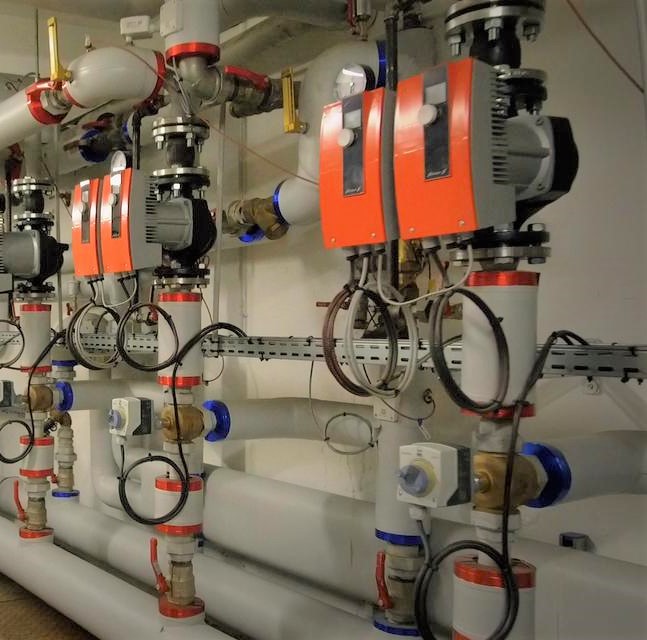

Agronergy

Sector: Energy

Country: France

Investment year: 2021

Asset description: Renewable heating specialist providing turnkey biomass and geothermal heating solutions to residential, commercial and public buildings and to municipal district heating networks.

Sustainability angle: Provides 12.7 GWh of renewable heat annually, contributing towards France’s objective to reduce carbon emissions from buildings, in line with the country’s decarbonisation targets.

GRESB score (2023): 83/100

Website: www.agronergy.fr

South East Water

Sector: Environment

Country: UK

Investment year: 2005 & 2017

Asset description: The largest water-only company in the UK supplying 543 million litres of water a day to customers across the South East of England.

Sustainability angle: Delivers sizeable investments to improve its infrastructure for its customers and the environment. In 2022/23, the company’s capital expenditure was £102m.

GRESB score (2023): 99/100

Website: www.southeastwater.co.uk

Ventus Investments

Sector: Energy

Country: UK

Investment year: 2015

Asset description: Portfolio of four operating wind farms in England and Wales representing 85MW in installed capacity

Sustainability angle: Represents over 69,000 emissions-free homes powered.

GRESB score (2023): English wind farms: 92/100 and Welsh wind farms: 88/100

Websites: www.pfr.co.uk/crook-hill , www.pfr.co.uk/reaps-moss, www.pennantwalters.co.uk/site/pant-y-wal/ and https://pennantwalters.co.uk/site/mynydd-bwllfa/

Past

Australian Registry Investments

Sector: Data

Country: Australia

Holding Period: 2017 - 2024

Asset description: Sole provider of land titling and registration services in New South Wales, the most populous state in Australia.

Sustainability angle: Delivery of 100% electronic lodgements, replacing prior paper-based filings.

GRESB score (2023): 99/100

Website: www.nswlrs.com.au

Phoenix Energy Group

Sector: Energy

Country: UK

Holding Period: 2013 - 2024

Asset description: Largest gas distribution network operator in Northern Ireland providing gas to over 250,000 properties through more than 4,000 km of pipelines.

Sustainability angle: Reduces Greater Belfast’s carbon emissions through conversion of oil heating systems to less polluting gas. 700,000+ tonnes of CO2 saved annually.

GRESB score (2023): 97/100

Website: www.phoenixenergyni.com/

Porterbrook

Sector: Transportation

Country: UK

Holding Period: 2014 - 2021

Asset description: Porterbrook is one of the UK’s leading rolling stock companies with c. 4,500 vehicles, representing approximately one quarter of Britain's passenger rolling stock fleet.

Sustainability angle: Porterbrook has a large electric fleet and is actively investing in designing new zero-emission engines (battery and hydrogen).

GRESB score (2021): 99/100

Website: www.porterbrook.co.uk

Redexis

Sector: Energy

Country: Spain

Holding Period: 2018 - 2021

Asset description: Integrated energy infrastructure company active in the development and operation of natural gas transmission and distribution networks, the distribution and sale of liquefied petroleum gas and the promotion of new gas-powered mobility infrastructure, renewable gas and hydrogen.

GRESB score (2021): 91/100

Sustainability angle: Actively involved in Spanish energy transition through its gas networks and investments in hydrogen, solar photovoltaic and natural gas for vehicles.

Website: https://www.redexis.es/en/

All figures as of 31 December 2023 except:

1 Australian Registry Investments (30 June 2023)

2 South East Water (31 March 2023)

3 Agronergy (31 December 2022)